June 19, 2014

VIA EDGAR

Securities and Exchange Commission

100 F Street, NE

Washington, D.C. 20549

Attention: Barbara C. Jacobs, Assistant Director

Re: Liberty TripAdvisor Holdings, Inc.

Amendment No. 1 to Registration Statement on Form S-1 (File No. 333-195705)

Dear Ms. Jacobs:

We hereby electronically file on behalf of Liberty TripAdvisor Holdings, Inc. (“TripCo”), under the Securities Act of 1933, as amended, Amendment No. 1 to its Registration Statement on Form S-1 (the “Registration Statement”), originally filed May 6, 2014. Defined terms used and not otherwise defined in this letter have the meanings ascribed to them in the Registration Statement.

Set forth below are responses to the comments contained in your letter to Gregory B. Maffei, President and Chief Executive Officer of TripCo, dated June 2, 2014 (the “SEC Letter”), regarding the Registration Statement. For your convenience, each of our responses below is preceded by the Staff’s comment. The numbered paragraphs below correspond to the numbered paragraphs in the SEC Letter. All section references refer to the corresponding sections of the Registration Statement filed herewith unless otherwise noted, and all page references in our responses are to the pages in the Registration Statement.

* * *

General

1. Comment: Tell us what consideration you gave to including pro forma financial statements in accordance with Article 11 of Regulation S-X and SAB Topic 1.B.2 to reflect the effects of the changes in operations that may have affected historical revenues or expenses had they been implemented at the beginning of the historical period. In this regard, we note your disclosure on page 72 that you will borrow term loans in the amount of $400 million, and $350 million of the amount borrowed will be distributed to Liberty prior to the spin-off. Please also clarify whether there are any new, or modified, cost sharing arrangements, management agreements, compensation plans, or tax sharing arrangements that should be reflected in the pro forma financial statements.

Response: TripCo believes the financial statements as presented are indicative of the on-going entity in all material respects. The entities identified for combination under TripCo are

separate, stand-alone entities with adequate corporate functions at each separate entity. As you noted, the primary difference between the historical financial statements and future financial statements will be the interest on the Margin Loan (the details of which have not been finalized but will likely be based on a variable rate plus an applicable spread) and any services, facilities or management agreements entered into at the time of the Spin-Off which will relate primarily to public company support. At the time of the initial filing of the Registration Statement and at present, these amounts were and are not known or estimable and they are expected to potentially change as the agreements have not yet been executed. Therefore we do not believe they would be included in accordance with Article 11. However, Liberty believes that the amounts will not significantly change the overall financial position of TripCo. TripCo believes the Capitalization table on page 54 with respect to the impact of the Margin Loans and the distribution to Liberty of a portion of the borrowings gives an adequate understanding of the anticipated balance sheet position of TripCo. In the interim period, Liberty has estimated these amounts, for liquidity discussion purposes, based on the current rate environment and an understanding of the level of effort to produce public financial information, and we have revised disclosures within the Liquidity and Capital Resources Section of Management’s Discussion and Analysis on page 76 to include what TripCo believes to be the high end of the range for these identified public company costs.

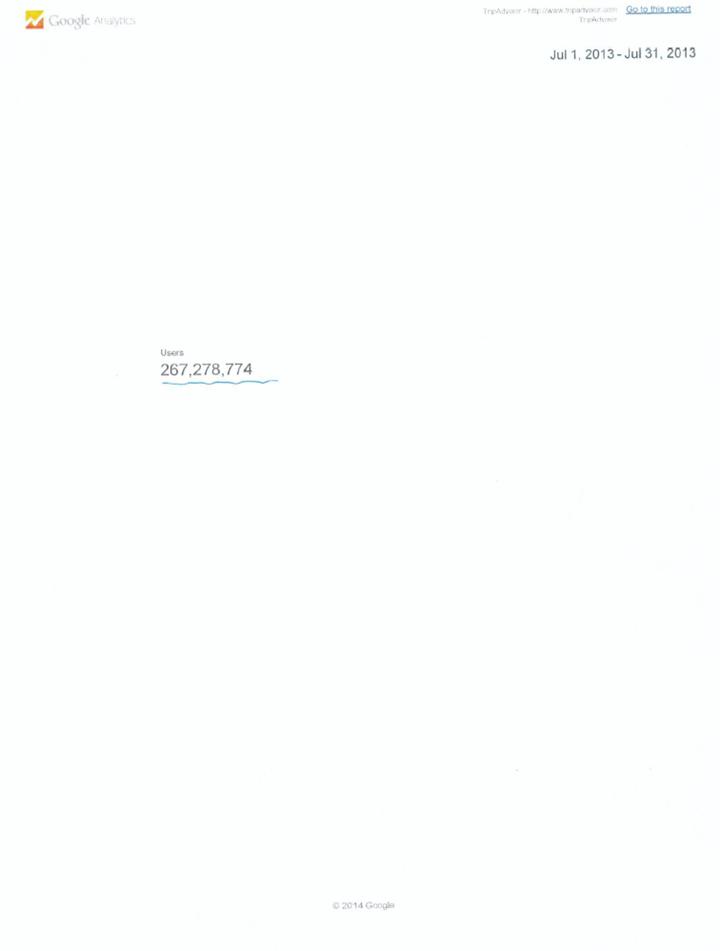

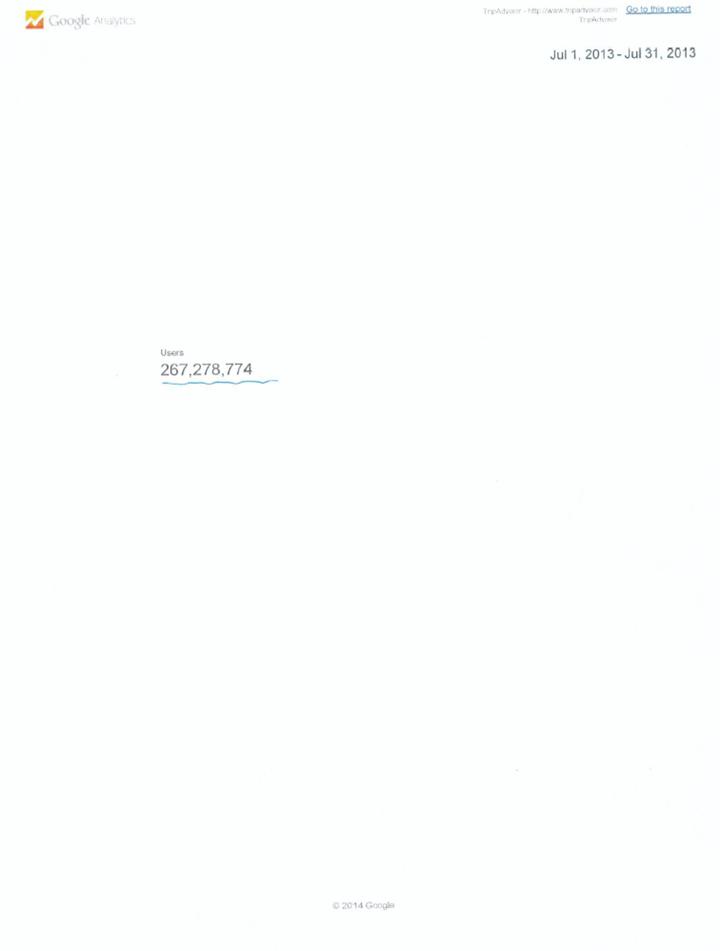

2. Comment: Please supplementally provide us with the documentation referred to in, or supporting, the following statements:

· “[TripAdvisor’s] branded websites globally have received more than 260 million monthly unique visitors during the year ended December 31, 2013, according to Google Analytics.”

· “TripAdvisor is the world’s largest online travel company.”

Please ensure that any materials supplementally provided are appropriately marked to highlight the sections relied upon and cross-referenced to your prospectus. Further, we note that at least one other company also claims in its public filings to be the world’s largest online travel company. In light of this, please include in your response any analysis necessary to reconcile this with your claim that TripAdvisor is the world’s largest online travel company.

Response: We note that the statements replicated above have been drawn from the public filings of TripAdvisor, more specifically its most recent Annual Report on Form 10-K for the fiscal year ended December 31, 2013. We have revised the disclosure on pages 57 and 65 of the Registration Statement to note that these statements are as of December 31, 2013 and have attached as Annex A to this correspondence materials provided by TripAdvisor in support of these statements, as revised.

2

3. Comment: Please revise to provide the disclosures required by Item 402 of Regulation S-K, or tell us why you are not required to do so. We refer you to Regulation S-K Compliance and Disclosure Interpretation Question 217.01 for guidance.

Response: We note your reference to Regulation S-K Compliance and Disclosure Interpretation (“C&DI”) Question 217.01 regarding the treatment of a spin-off as an IPO of a new “spun-off” registrant for purposes of disclosure pursuant to Item 402 of Regulation S-K. In determining not to include the disclosures required by Item 402, TripCo considered this C&DI and, as proscribed, assessed whether TripCo could be considered a reporting company or separate division of Liberty prior to the Spin-Off, as well as the proposed composition of management.

As described in the Registration Statement, TripCo is a subsidiary of Liberty formed for the purpose of completing the Spin-Off, and, following the Spin-Off, TripCo will hold portions of Liberty’s current businesses: BuySeasons is part of Liberty’s e-commerce businesses, and the TripAdvisor interest is an investment, accounted for as a consolidated subsidiary, of Liberty’s Ventures Group. Accordingly, TripCo will not conduct a single line of Liberty’s businesses and does not constitute a separate division of Liberty.

With respect to the proposed management of TripCo, we note that it is currently contemplated that certain members of Liberty management will serve in similar capacities at TripCo while continuing to provide services to Liberty. Hence, the management of TripCo is more akin to management of an IPO company as discussed in the C&DI where there is no continuity of management of the underlying businesses. Further, Liberty and TripCo believe that the historical compensation provided to management of Liberty for providing services to the parent company holds no correlation to the transition services these persons will be providing to TripCo pursuant to the Services Agreement with Liberty Media following the Spin-Off.

For these reasons, TripCo respectfully submits that the Spin-Off should be treated as an IPO for purposes for Item 402 disclosure and accordingly should not be required to include this disclosure in the Registration Statement.

Outside Front Cover Page of Prospectus

4. Comment: Please revise to clarify and provide context about the nature of the Liberty Interactive Corporation’s Ventures Group and Interactive Group stock. Consider including a cross-reference to more fulsome disclosure in the prospectus that further explains the ownership interests of these series of common stock, both pre- and post-spin-off. Refer to our comments 6 and 7 below.

Response: We have revised the disclosure on the outside front cover of the prospectus in the Registration Statement and pages 2 and 43 of the Registration Statement in response to the Staff’s comment.

5. Comment: Please disclose Mr. Malone’s ownership interest.

3

Response: We have revised the disclosure on the outside front cover of the prospectus in the Registration Statement in response to the Staff’s comment.

Summary

Our Company, page 1

6. Comment: Please consider providing an organizational chart that outlines the corporate structure and shows the changes and percentages of ownership of the various parties pre- and post-spin-off and reclassification.

Response: We have revised the disclosure on pages 3 through 8 of the Registration Statement in response to the Staff’s comment.

7. Comment: Please enhance your disclosure here and elsewhere in your prospectus, as appropriate, by providing a brief overview of the businesses, assets, and liabilities that comprise each of Liberty’s Ventures Group and Interactive Group both pre- and post-spin-off. Please ensure that your disclosure clearly indicates whether any assets and liabilities currently comprising Liberty’s Ventures Group, other than those being spun-off, will be redistributed in connection with the spin-off or the Proposed Reclassification to the Interactive Group (or to the QVC Group or Liberty Digital Commerce if the spin-off occurs after or concurrently with the Proposed Reclassification).

Response: We have revised the disclosure on pages 2 and 43 of the Registration Statement in response to the Staff’s comment.

The Spin-Off, page 2

8. Comment: To the extent possible, please quantify the costs associated with the proposed transactions. Please also clarify which entity will bear such costs.

Response: We have revised the disclosure on page 10 of the Registration Statement in response to the Staff’s comment.

9. Comment: Please discuss whether the board considered alternatives to the spin-off and, if so, why they were rejected.

Response: We have revised the disclosure on pages 13 and 45 of the Registration Statement in response to the Staff’s comment.

10. Comment: Please provide information regarding the impact of sales of Liberty Ventures Group shares on or before the distribution date.

Response: We have revised the disclosure on page 12 of the Registration Statement in response to the Staff’s comment.

4

“What transactions are occurring in connection with the Spin-Off other than those involved in the internal restructuring?,” page 4

11. Comment: Please tell us, with a view towards revised disclosure, the identities of and the nature of your relationship with the third parties that are expected to guarantee the margin loans to be drawn by TripSPV.

Response: We have revised the disclosure on pages 10, 25 and 85 of the Registration Statement in response to the Staff’s comment to indicate that TripCo will be the sole guarantor of the Margin Loans.

12. Comment: We note that Liberty intends to use the full $350 million of loan proceeds to be received from TripCo to repurchase shares of Liberty common stock. Please state whether the Liberty Ventures Group shareholders will be eligible to have their Liberty Ventures shares repurchased under Liberty’s share repurchase program.

Response: We have revised the disclosure on page 10 of the Registration Statement in response to the Staff’s comment.

“What will the relationship be between TripCo and Liberty after the Spin-Off?,” page 4

13. Comment: Please expand this Q&A to provide more fulsome information on your expectations regarding your ongoing relationship with Liberty after the spin-off. For example, consider discussing the nature of your arrangements with Liberty and the period of time you expect these arrangements to continue after the spin-off.

Response: We have revised the disclosure on pages 10 and 11 of the Registration Statement in response to the Staff’s comment.

Risk Factors

“Each of our company and TripAdvisor has significant indebtedness, which could adversely affect its business and financial condition,” page 18

14. Comment: Please expand the heading and text of this risk factor to further explain both your and TripAdvisor’s debt loads, including information regarding your and TripAdvisor’s debt service obligations.

Response: We have revised the disclosure on pages 25 through 27 of the Registration Statement in response to the Staff’s comment.

5

The Spin-Off

Reasons for the Spin-Off, page 36

15. Comment: We note you statements here and elsewhere in the document that in determining to approve the spin-off, Liberty believes that the trading discount applied to Liberty Ventures common stock will be reduced “because separating TripCo will better highlight the discount at which the Liberty Ventures common stock historically has traded relative to the underlying asset composition of the Liberty Ventures tracking stock group.” Additionally, we note the expectation that investors will have greater transparency with respect to your dominant business, TripAdvisor. Please explain why it was determined that the BuySeasons business should also be included in the spun-off entity, particularly in light of the fact that BuySeasons has not historically been included under the Liberty Ventures Group asset composition.

Response: We have revised the disclosure on pages 43 and 44 of the Registration Statement in response to the Staff’s comment.

Conditions to the Spin-Off, page 38

16. Comment: Please clarify whether closing of the margin loans that you refer to on page 72 is also a condition of the spin-off.

Response: We have revised the disclosure on pages 9 and 46 of the Registration Statement in response to the Staff’s comment.

Description of Our Business

TripAdvisor, Inc., page 49

17. Comment: Please tell us, with a view towards revised disclosure, how TripAdvisor’s arrangements with Expedia will be impacted by the spin-off, including whether the various agreements with Expedia entered in connection with Expedia’s spin-off of TripAdvisor will remain in effect. To the extent any of your agreements with Expedia are material, please update your disclosure to provide a brief description of the material terms of such agreements.

Response: We have revised the disclosure on page 60 of the Registration Statement in response to the Staff’s comment. We note, as explained in the revised disclosure, that TripAdvisor remains subject to only one of the various agreements entered into with Expedia in connection with its spin-off from Expedia, and further, the commercial agreements entered into on arms’-length terms between TripAdvisor and Expedia in connection with that spin-off have since been renegotiated with TripAdvisor and Expedia as separate public companies. TripCo does not expect any of these agreements to be impacted by the Spin-Off.

BuySeasons, page 52

18. Comment: Please provide additional information regarding BuySeason’s corporate history, including whether it was formed or acquired by Liberty and when.

6

Response: We have revised the disclosure on page 61 of the Registration Statement in response to the Staff’s comment.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Strategies and Challenges, page 57

19. We note your disclosure that you have included an executive summary of the strategies and challenges of TripAdvisor only as this is your most significant operating business. In light of the fact that your entire operations post spin-off will be comprised of both your partial interest in TripAdvisor and your 100% interest in BuySeasons, and in light of the operating losses and decreases in revenue over recent periods sustained by BuySeasons, please tell us your consideration for including a more balanced and meaningful discussion of known material trends and uncertainties that will have, or are reasonably likely to have, a material impact on your revenues or income or result in your liquidity decreasing or increasing in any material way as a combined entity, as well as how management plans to address these issues.

Response: Liberty believes TripCo’s discussion of the operating results of BuySeasons within the “Results of Operations—Combined” section provides financial statement users with adequate insight into the operational struggles for BuySeasons. As BuySeasons does not meet the criteria as a reportable segment based on financial metrics, such as Revenue and Adjusted OIBDA in the current period, a discussion of the results of BuySeasons as disclosed within the “Results of Operations—Combined” was considered appropriate for a balanced and meaningful discussion of the combined business. Liberty and TripCo believe that BuySeasons will continue to work towards operational breakeven with potential positive cash flows over time. This anticipated outcome will further diminish the impact of BuySeasons’ results as a percentage of the combined results compounded by the anticipated additional growth of TripAdvisor. We have updated the disclosures within these sections on page 74 of the Registration Statement to give greater clarity to any potential trends and uncertainties with respect to the BuySeasons business including future efforts for cost containment.

Liquidity and Capital Resources, page 63

20. Comment: Please revise to disclose the minimum period of time that you will be able to conduct planned operations using only currently available capital resources. We refer you to Item 303(a)(1) of Regulation S-K and Instructions 2 and 3 to Item 303(a) of Regulation S-K for additional guidance. Additionally, please address the impact on your liquidity of the new indebtedness expected to be assumed in connection with the spin-off.

Response: We have revised the disclosure on page 76 of the Registration Statement in response to the Staff’s comment.

7

Results of Operations—TripAdvisor, page 68

21. Comment: Explain why you have included financial information for the year ended December 31, 2013 based on TripAdvisor, Inc.’s financial statements instead of TripCo. In this regard, clarify why you are not discussing TripCo’s historical results of operations for 2013 compared to TripCo’s pro forma results of operations for 2012. TripCo’s pro forma results of operation would combine TripCo’s and TripAdvisor, Inc.’s historical results with pro forma adjustments.

Response: TripCo does not believe that it has included financial information for TripAdvisor instead of financial information for TripCo. Rather, TripCo has placed the “Results of Operations—Combined” section as the first and more prominent discussion which, by including this disclosure in broader discussion of the overall combined GAAP results, gives appropriate weight to the financial measures used by TripCo’s management as well as the GAAP financial information. Rather than unnecessarily duplicating disclosure regarding the TripAdvisor business in this section, TripCo has supplementally provided a more detailed discussion of the significant drivers of the TripAdvisor business in “Results of Operations—TripAdvisor” which gives the financial statement users a better understanding of the underlying business that drives the most significant portion of the combined results. TripAdvisor is TripCo’s only reportable segment based on a quantitative and qualitative analysis of the separate operating segments. As TripAdvisor grows organically and purchase accounting adjustments are fully amortized, TripCo believes that the results of TripAdvisor in future periods will only become a greater driver of the combined results. TripCo considered the inclusion of pro forma financials, which would have mainly included amortization from the application of purchase accounting (which is excluded from TripCo’s discussion of Adjusted OIBDA) and would have resulted in a similar supplemental discussion of the key drivers of TripAdvisor’s stand-alone results. TripCo believes that the discussion as structured, the results of the combined entity with supplemental information of the stand-alone results of TripAdvisor (including a discussion of TripAdvisor’s full year 2012 and 2011 results) as reconciled to the Liberty reported GAAP results (including a discussion of TripAdvisor’s full year 2012 and 2011 results), gives appropriate weight to and provides adequate disclosure regarding all the various aspects of the combined entity.

Description of Certain Indebtedness

Margin Loans, page 72

22. Comment: Please expand your disclosure to discuss what constitutes a “default” under the terms of your margin loans.

Response: We have revised the disclosure on pages 85 and 86 of the Registration Statement in response to the Staff’s comment.

8

Security Ownership of Certain Beneficial Owners and Management

Security Ownership of Certain Beneficial Owners, page 77

23. Comment: In footnotes 5 and 6, please disclose the person or persons who have sole or shared voting and/or investment power over the securities owned by each legal entity. See Instruction 2 to Item 403 of Regulation S-K.

Response: We have reviewed the Security Ownership of Certain Beneficial Ownership table and footnotes 5 and 6 thereto. We note that the information contained in the table and footnotes 5 and 6 thereto with respect to FPR Partners, LLC (“FPR Partners”) and Jana Partners LLC (“Jana Partners”) is based on Schedule 13G/As filed by each of those parties on February 14, 2014 with respect to their holdings of Liberty Interactive’s Series A Liberty Ventures common stock. The report of FPR Partners states that FPR Partners has sole voting and dispositive power over its shares reported in the table and the report of Jana Partners states that Jana Partners has sole voting and dispositive power over its shares reported in the table. We note that the extent of TripCo’s knowledge is based upon such publicly available 13G/A filings, and, as such, have provided as much detail in footnotes 5 and 6 as is available to us.

Security Ownership of Management, page 78

24. Comment: Footnote 4 contains a disclaimer of beneficial ownership. Beneficial ownership disclosure in this table is based on voting and/or investment power. See Instruction 2 to Item 403 of Regulation S-K and Exchange Act Rule 13d-3. To the extent that you retain this disclaimer, please provide us with a legal analysis supporting your belief that beneficial ownership disclaimers are proper outside of filings on Schedules 13D and 13G, and disclose who has voting and/or investment power over the disclaimed shares.

Response: We have revised the disclosure on page 97 of the Registration Statement in response to the Staff’s comment.

Certain Relationships and Related Party Transactions, page 82

25. Comment: Please expand the introductory paragraph to this section to further describe your policies and procedures for the review of transactions with related persons. For example, please explain the types of transactions that will be covered by this policy, including whether there is a minimum threshold amount for a transaction with a related person to require board review. We refer you to Item 404(b) of Regulation S-K.

Response: We have revised the disclosure on page 98 of the Registration Statement in response to the Staff’s comment.

26. Comment: We note your disclosure in Note 11 that Expedia is a related party. Tell us what consideration you gave to separately stating transactions with Expedia on the face

9

of the balance sheet, income statement, and statement of cash flows. We refer you to Rule 4-08(k) of Regulation S-X.

Response: TripAdvisor on a stand-alone basis has determined that Expedia is no longer a related party as, with one exception, all previous agreements which were entered into at the time of TripAdvisor’s spin-off from Expedia have lapsed or been renegotiated on an arms’-length basis between TripAdvisor and Expedia as separate publicly traded companies, as discussed above in our response to Comment 17. TripCo agrees with this analysis and therefore, believes that Expedia will not be a related party for TripCo as a stand-alone entity. TripCo further believes that because Expedia is an equity method affiliate of Liberty (which, prior to the Spin-Off, is the parent of TripCo), the relationship between Expedia and TripAdvisor is still relevant for users of the financial statements (until the time of Spin-Off) but not technically a related party relationship as defined under the GAAP definition because TripCo does not have a direct relationship with Expedia. TripCo believes that, at the time of the Spin-Off, these disclosures will no longer be applicable as all the entities will be separate publicly traded companies with no beneficial ownership interest in the other. We have updated the disclosure on page F-33 of the Registration Statement to replace the use of the term “related party” with the term “affiliated entity” based on Liberty’s current ownership of TripCo and believe that, as revised, the information provided for users of the financial statements is appropriate.

Notes to Combined Financial Statements

(1) Basis of Presentation

Spin-Off of TripCo from Liberty Interactive Corporation, page F-8

27. Comment: We note your disclosure that the TripCo spin-off is intended to be accounted for at historical cost due to the pro rata nature of the distribution to shareholders of Liberty Ventures common stock. Tell us the authoritative accounting literature upon which you are relying in making this determination. In this regard, we note that the TripCo spin-off will be effected as a pro rata dividend of shares of TripCo to only the stockholders of Liberty Ventures common stock. As such, it appears that the shareholder ownership group of TripCo will be different than the shareholder ownership group of Liberty. Tell us how you took these factors into consideration in determining the accounting basis of this transaction.

Response: TripCo based this determination on ASC 845-10-30-13 which states that a split-off of a targeted business, distributed on a pro rata basis to holders of the related targeted stock, shall be accounted for at historical cost. We note that the relevant guidance states that when a targeted stock (here, the Liberty Ventures common stock) is created in contemplation of the subsequent split-off, the two-steps (creation of the targeted stock and the split-off) cannot be separated and shall be viewed as one transaction with the split-off being accounted for at fair value. However, in the case at hand, the Liberty Ventures common stock was not created in contemplation of the Spin-Off and, in fact, was created prior to Liberty’s acquisition of a

10

controlling interest in TripAdvisor. Accordingly, TripCo believes that the relevant guidance would indicate that it is appropriate to account for the Spin-Off at historical cost.

28. Comment: Please further explain the basis of presentation of your financial statements, including whether you consider the businesses acquired to represent discrete activities for which assets and liabilities are specifically identifiable. Clarify whether the financial statements reflect any allocations of assets and liabilities, or any allocations of general corporate expenses such as management, finance, legal, information technology, human resources, or other shared services, and the basis for such allocations. We refer you to SAB Topic 1.B. Also clarify whether the financial statements reflect all assets and liabilities of the acquired businesses, including those that will not be acquired/assumed as part of the acquisitions, and are representative of the company as if it had operated on a stand-alone basis. Describe any such assets/liabilities that will not be acquired. Clarify your disclosures accordingly.

Response: TripCo believes that financial presentation of the combined entities included in the financial statements adequately includes all material costs of TripCo. As discussed in the response to Comment 1, the entities that are combined for TripCo are stand-alone operating entities (with adequate corporate functions) and any go-forward agreements and costs for public company oversight were undeterminable at the time of filing the Registration Statement and remain so. In the interim, Liberty and TripCo have tried to estimate these costs within a range and have disclosed the high end of the estimated range on page 76 of the Registration Statement. These amounts were not considered significant and TripCo believes the financial statements as presented are indicative of the ongoing entity.

29. Comment: Please clarify your disclosure to indicate whether you have incurred, or expect to incur, any significant separation expenses in connection with this transaction, including advisory, legal, accounting, and severance. Disclose the dollar amount of such expenses and clarify whether they are included or excluded in these financial statements.

Response: Separation costs are expected to be paid by Liberty and have been disclosed on page 51 of the document. Since these costs will be incurred by Liberty, they will have no impact on TripCo’s financial position.

(2) Summary of Significant Accounting Policies

Revenue Recognition

Merchandise Sales, page F-13

30. Comment: Please clarify whether your recognize revenue gross of amounts paid to your suppliers, or the net commission. Tell us how you considered the provisions of ASC 605-45 in making this determination. As part of your response, clarify how your revenue is determined for these transactions, and whether you earn a fixed percentage of the price negotiated between the suppliers and customers, or whether you determine the selling

11

price of the merchandise. Please also clarify whether you are responsible for fulfillment of the orders.

Response: Merchandise sales through the BuySeasons websites are recognized when the product is delivered to the customer. All merchandise sales are fulfilled by BuySeasons through its distribution center and the prices are set by BuySeasons. Transactions with customers do not impact the amounts paid to suppliers or net commissions paid. BuySeasons takes on the risks and rewards associated with inventory sold through their websites. TripCo believed that consideration of the provisions of ASC 605-45 was not necessary as a principal agent relationship associated with merchandise sales does not exist.

(6) Goodwill and Other Intangible Assets, page F-20

31. Comment: Please tell us how you determined the amount of goodwill and intangibles to attribute to BuySeasons. Please clarify your disclosures accordingly.

Response: The consolidated subsidiaries of BuySeasons were acquired in previous periods, as more fully disclosed on page 61 of the Registration Statement in response to Comment 18, and were considered a separate reporting unit for Liberty. At the time of acquisition, purchase accounting was applied and goodwill and other intangibles were recognized for each individual acquisition. The goodwill and other intangibles determined for purposes of these combined financial statements was the carrying value of these assets. We note that most of the intangibles and goodwill, associated with BuySeasons entities, were either impaired or fully amortized as of the most recent reporting period. We have revised the disclosure on page F-20 of the Registration Statement to add clarifying disclosure.

(7) Debt, page F-22

32. Comment: We note your disclosure that BuySeasons borrowed $30 million pursuant to its loan agreement with Liberty. Please clarify your disclosures to indicate whether this was in addition to the $11 million borrowed under the promissory note issued to Liberty from BuySeasons. Clarify how these debt balances and related interest expense are reflected in your financial statements and how your presentation complies with SAB Topic 1.B.1. Also, clarify whether this debt will be assumed by Liberty in connection with the spin-off.

Response: We have revised the disclosure on page F-34 of the Registration Statement to clarify that the $30 million, as disclosed on the face of the financial statements, is the total of all Liberty loans at December 31, 2013. The interest expense on the related party note is included in the interest expense line item in the statement of operations and, for further clarity, a cross reference to a discussion of the related party note in Footnote 11 (Related Party Transactions) is included. BuySeasons had a third-party loan agreement until an event of default occured, as discussed in Footnote 11. The related party interest is effectively the replacement of third party interest at the BuySeasons level, and TripCo believes all appropriate interest charges have been captured in the combined statements. Liberty and TripCo anticipate the loan balance

12

will be contributed to the capital of BuySeasons prior to the time of the Spin-Off, and TripCo has included a statement to this effect in Footnote 11.

(8) Income Taxes, page F-24

33. Comment: We note your disclosure that TripCo, as combined, was included in the federal consolidated income tax return of Liberty during the periods presented. We further note your disclosure that TripAdvisor is not included in the Liberty consolidated group tax return and is not expected to be included in the TripCo tax return upon the completion of the spin-off as TripCo owns less than 80% of TripAdvisor. Please reconcile these statements as they appear contradictory.

Response: TripCo, as a 100% owned subsidiary of Liberty, is included in the consolidated income tax return of Liberty for all periods prior to the Spin-Off. TripAdvisor, although a consolidated subsidiary of Liberty for financial statement purposes, is less than 80% owned by Liberty and therefore not included in the Liberty consolidated income tax return nor will it be included in the future consolidated tax returns of TripCo based on current ownership levels. We have added clarification within Footnote 8 (Income Taxes) on page F-24 of the Registration Statement.

34. Comment: We note that you recognized a tax benefit of $46 million relating to a change in tax rate, which required an adjustment to the recognized deferred taxes at the TripAdvisor level. Tell us how this tax benefit is reflected in the rate reconciliation included in TripAdvisor Inc.’s Form 10-K for the year ended December 31, 2013.

Response: The phrase “TripAdvisor level” within the context of the discussion on the change in tax rate refers to TripCo’s or Liberty’s view of TripAdvisor. Push down accounting was not allowed, based on the level of ownership, therefore the goodwill, intangibles and other assets and liabilities recognized at fair value upon acquiring a controlling interest in TripAdvisor are accounted for in a separate ledger (the “Inflight Ledger”). A significant deferred tax liability (primarily related to intangibles) was recorded at the time of acquisition due to the recognition of assets and liabilities at fair value versus the tax basis at December 11, 2012. To give perspective, at December 31, 2013 the combined net deferred tax liability at TripCo was $846 million and the net deferred tax liability at TripAdvisor was $7 million. Therefore, a slight change in tax rate has a more significant impact for TripCo than for TripAdvisor and as the amount was not individually significant it was included in the state income taxes, net of effect of federal tax benefit, line item in the TripAdvisor rate reconciliation.

(12) Commitments and Contingencies

Operating Leases, page F-35

35. Comment: Please clarify whether the rental expense and the future minimum lease commitments that you disclose include any allocated expenses for BuySeasons and, if so, describe how such amounts were determined.

13

Response: BuySeasons is a separate stand-alone entity and therefore has its own minimum lease commitments which are included in TripCo’s disclosed future minimum lease commitments table. We note that there are no allocated expenses included in the future minimum lease commitments as disclosed.

Report of Independent Registered Public Accounting Firm, page F-39

36. Comment: The report contains references to disclosures provided in TripAdvisor, Inc.’s Form 10-K that are not included in this filing. In addition, the notes to the financial statements provide similar references. Please revise your disclosures to conform to this filing.

Response: We have revised the report to remove the reference to disclosures provided in TripAdvisor’s Form 10-K. However, we note that the notes referred to were extracted from and form a part of TripAdvisor’s Annual Report on Form 10-K for the year ended December 31, 2013 and are part of that entity’s audited financial statements. Although TripCo is not permitted to make revisions to the notes to these audited financial statements, TripCo believes that a reader will be able to clearly identify the applicable TripAdvisor Form 10-K disclosure referenced in the notes to the financials statements should the reader wish to review these disclosures in TripAdvisor’s Form 10-K. By retaining these references to TripAdvisor’s Form 10-K, TripCo is not attempting to incorporate such disclosures by reference but rather direct a reader to the applicable disclosure.

37. Comments: Since you acquired TripAdvisor, Inc. on December 11, 2012, tell us why you are providing a full set of financial statements for TripAdvisor, Inc. for the three years ending December 31, 2013. Indicate whether these financial statements are being provided to satisfy Rule 3-05 of Regulation S-X. Further, describe your consideration of whether TripAdvisor, Inc. represents a predecessor to TripCo.

Response: TripCo considered whether TripAdvisor, Inc. represented a predecessor to TripCo. We reviewed Leslie Overton’s 2006 Speech by SEC Staff: Remarks before the 2006 AICPA National Conference on Current SEC and PCAOB Developments. In this speech, it is noted that the predecessor is the entity that is first controlled by the parent. In consideration that Liberty owned BuySeasons several years prior to owning its investment in TripAdvisor, Inc., TripCo concluded that BuySeasons was the predecessor.

We have included the financial statements for TripAdvisor, Inc. for the two years ended December 31, 2012 to satisfy the reporting requirements of Rule 3-05 (satisfaction of “Major Significance” under section 2040.2 of the Financial Reporting Manual) of Regulation S-X. Since TripAdvisor, Inc. already has publicly available financial statements, we determined that instead of only providing prior period financial statements in accordance with Rule 3-05 of Regulation S-X, we would include the year ended December 31, 2013, as this would be most useful to the readers of the TripCo financial statements.

14

Exhibits

38. Comment: Please file all of your exhibits that are to be filed by amendment as soon as practicable. We will need adequate time to review, in particular those related to the spin-off and your ongoing relationship with Liberty, and, if necessary, comment upon your disclosure regarding them.

Response: We have filed with the Registration Statement all exhibits that are available at this time.

39. Comments: We note that a number of agreements that appear to be material to your business and operations have not been filed or included in your exhibit list. For example, it appears you should file the agreements governing TripAdvisor’s relationships with its most significant advertising customers, Expedia and Priceline. See Item 601(b)(10) of Regulation S-K. Please file or incorporate by reference such agreements, and ensure that any other such material agreements have been filed as exhibits to your registration statement. Further, please ensure that the material terms of such agreements are described in your prospectus.

Response: We have revised the Registration Statement to include exhibits material to TripCo. Included among those exhibits is TripAdvisor’s standard form of advertising agreement, which it has entered into with Expedia, Priceline, and its other online travel agency (“OTA”) customers. TripAdvisor’s advertising agreements do not contain pricing terms, as pricing is determined pursuant to the OTA bidding process, but do contain terms related to payment mechanics, advertising criteria and other general provisions. TripCo believes that the description of the business of TripAdvisor included in the Registration Statement complies in all respects with Item 101 of Regulation S-K and gives the reader a fulsome understanding of the business and operations of TripAdvisor, including as to how business relationships are conducted with third-party providers. Therefore, TripCo does not believe that any additional summaries are required to comply with applicable rules and regulations.

* * *

If you have any questions with respect to the foregoing or require further information, please contact the undersigned at (212) 408-2503.

|

|

Very truly yours, |

|

|

|

|

|

/s/ Renee L. Wilm |

|

|

Renee L. Wilm |

|

|

|

|

cc: |

Liberty TripAdvisor Holdings, Inc. |

|

|

|

Richard N. Baer |

|

|

|

|

|

|

|

KPMG LLP |

|

|

|

H. Michael Keys |

|

15

|

|

30 ROCKEFELLER PLAZA

NEW YORK, NEW YORK

10112-4498

TEL +1 212.408.2500

FAX +1 212.408.2501

BakerBotts.com |

|

ABU DHABI

AUSTIN

BEIJING

BRUSSELS

DALLAS

DUBAI

HONG KONG |

|

HOUSTON

LONDON

MOSCOW

NEW YORK

PALO ALTO

RIO DE JANEIRO

RIYADH

WASHINGTON |

Annex A: Documents Relating to Comment 2

|

|

|

Jan-13 |

|

Feb-13 |

|

Mar-13 |

|

Apr-13 |

|

May-13 |

|

Jun-13 |

|

Jul-13 |

|

Aug-13 |

|

Sep-13 |

|

Oct-13 |

|

Nov-13 |

|

Dec-13 |

|

|

Comscore Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TripAdvisor Inc. |

|

75,748 |

|

67,560 |

|

77,285 |

|

78,527 |

|

81,542 |

|

86,182 |

|

105,335 |

|

102,069 |

|

88,218 |

|

84,025 |

|

77,081 |

|

72,293 |

|

|

Ctrip.com International |

|

27,214 |

|

23,357 |

|

26,778 |

|

41,707 |

|

42,200 |

|

43,826 |

|

50,372 |

|

51,458 |

|

48,249 |

|

45,233 |

|

46,226 |

|

52,697 |

|

|

Tripadvisor Sites |

|

60,165 |

|

57,336 |

|

66,056 |

|

64,605 |

|

66,411 |

|

70,373 |

|

83,450 |

|

82,274 |

|

69,700 |

|

66,895 |

|

60,566 |

|

53,091 |

|

|

Booking.com Europe |

|

44,413 |

|

43,253 |

|

48,072 |

|

50,101 |

|

48,927 |

|

52,851 |

|

64,918 |

|

62,591 |

|

50,830 |

|

50,386 |

|

48,701 |

|

44,254 |

|

|

QUNAR.COM |

|

31,502 |

|

23,952 |

|

28,637 |

|

45,051 |

|

42,867 |

|

42,990 |

|

50,528 |

|

46,287 |

|

45,312 |

|

41,308 |

|

40,572 |

|

50,973 |

|

|

Expedia Sites |

|

30,680 |

|

29,316 |

|

32,181 |

|

30,417 |

|

30,237 |

|

32,435 |

|

36,440 |

|

34,023 |

|

30,489 |

|

29,565 |

|

28,136 |

|

26,027 |

|

|

KUXUN.CN |

|

9,854 |

|

4,751 |

|

5,578 |

|

8,748 |

|

10,096 |

|

10,447 |

|

16,927 |

|

15,930 |

|

13,797 |

|

12,340 |

|

11,788 |

|

14,895 |

|

|

Elong Sites |

|

7,635 |

|

6,547 |

|

9,803 |

|

16,698 |

|

17,304 |

|

18,044 |

|

22,466 |

|

23,282 |

|

20,138 |

|

19,820 |

|

17,983 |

|

18,923 |

|

|

Indian Railways |

|

14,277 |

|

13,143 |

|

14,088 |

|

14,723 |

|

16,412 |

|

15,052 |

|

13,972 |

|

14,701 |

|

16,344 |

|

17,203 |

|

16,797 |

|

17,043 |

|

|

HOTELS.COM Sites |

|

16,330 |

|

14,501 |

|

17,106 |

|

15,040 |

|

16,960 |

|

17,561 |

|

21,302 |

|

19,360 |

|

15,346 |

|

22,152 |

|

18,704 |

|

13,693 |

|

|

Agoda |

|

15,866 |

|

14,739 |

|

15,966 |

|

14,690 |

|

17,952 |

|

19,774 |

|

19,376 |

|

18,802 |

|

17,938 |

|

15,888 |

|

14,865 |

|

15,812 |

|

|

Yahoo Travel |

|

19,994 |

|

20,602 |

|

22,578 |

|

21,981 |

|

20,627 |

|

18,305 |

|

20,521 |

|

20,131 |

|

17,412 |

|

15,083 |

|

18,085 |

|

14,590 |

|

|

HomeAway |

|

10,736 |

|

9,749 |

|

10,765 |

|

10,078 |

|

10,159 |

|

11,561 |

|

13,830 |

|

12,198 |

|

9,694 |

|

9,352 |

|

8,501 |

|

7,989 |

|

|

SOHU.COM Travel |

|

6,343 |

|

6,487 |

|

6,762 |

|

14,358 |

|

24,334 |

|

12,223 |

|

14,055 |

|

14,401 |

|

15,293 |

|

13,838 |

|

11,358 |

|

11,579 |

|

|

eDreams |

|

9,072 |

|

8,148 |

|

9,486 |

|

9,817 |

|

9,879 |

|

11,276 |

|

14,299 |

|

14,455 |

|

13,859 |

|

12,153 |

|

11,286 |

|

10,842 |

|

|

PRICELINE.COM |

|

12,325 |

|

11,832 |

|

12,773 |

|

11,823 |

|

12,279 |

|

13,241 |

|

14,678 |

|

12,249 |

|

10,817 |

|

9,485 |

|

9,188 |

|

7,601 |

|

|

Trivago Sites |

|

5,647 |

|

5,387 |

|

5,808 |

|

6,144 |

|

7,238 |

|

9,055 |

|

13,683 |

|

15,162 |

|

9,532 |

|

9,076 |

|

7,917 |

|

6,199 |

|

|

Kayak.com Network |

|

14,581 |

|

13,739 |

|

14,849 |

|

13,264 |

|

12,439 |

|

11,311 |

|

13,901 |

|

11,980 |

|

9,688 |

|

9,529 |

|

8,306 |

|

7,715 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Travel |

|

561,280 |

|

520,336 |

|

554,378 |

|

594,254 |

|

591,203 |

|

607,372 |

|

645,142 |

|

634,237 |

|

616,046 |

|

610,739 |

|

610,211 |

|

609,948 |

|

|

% covered by TA |

|

10.7 |

% |

11.0 |

% |

11.9 |

% |

10.9 |

% |

11.2 |

% |

11.6 |

% |

12.9 |

% |

13.0 |

% |

11.3 |

% |

11.0 |

% |

9.9 |

% |

8.7 |

% |

|

% reach difference to nearest competition |

|

-20.6 |

% |

-15.1 |

% |

-14.5 |

% |

-17.7 |

% |

-18.6 |

% |

-18.3 |

% |

-20.8 |

% |

-19.4 |

% |

-21.0 |

% |

-20.4 |

% |

-21.4 |

% |

-26.6 |

% |

|

% covered by TAMG |

|

13.5 |

% |

13.0 |

% |

13.9 |

% |

13.2 |

% |

13.8 |

% |

14.2 |

% |

16.3 |

% |

16.1 |

% |

14.3 |

% |

13.8 |

% |

12.6 |

% |

11.9 |

% |

|

Total Internet : Total Audience |

|

1,530,895 |

|

1,526,768 |

|

1,554,797 |

|

1,560,778 |

|

1,566,524 |

|

1,572,688 |

|

1,582,029 |

|

1,596,237 |

|

1,604,290 |

|

1,611,886 |

|

1,619,952 |

|

1,627,086 |

|

|

% covered by travel sites |

|

36.7 |

% |

34.1 |

% |

35.7 |

% |

38.1 |

% |

37.7 |

% |

38.6 |

% |

40.8 |

% |

39.7 |

% |

38.4 |

% |

37.9 |

% |

37.7 |

% |

37.5 |

% |